So you are a developer and want to start accepting payments using PayPay. PayPay's Payment SDK is the simplest way to achieve the integration. With PayPay's Payment SDK, you can build a custom Payment checkout process to suit your unique business needs and branding guidelines.

QR Code flow is recommended normally in the following scenarios

- Payment to happen on a Tablet

- Payments on Vending Machines

- Payment to happen on a TV Screen

- Printing a QR Code for Bill Payment

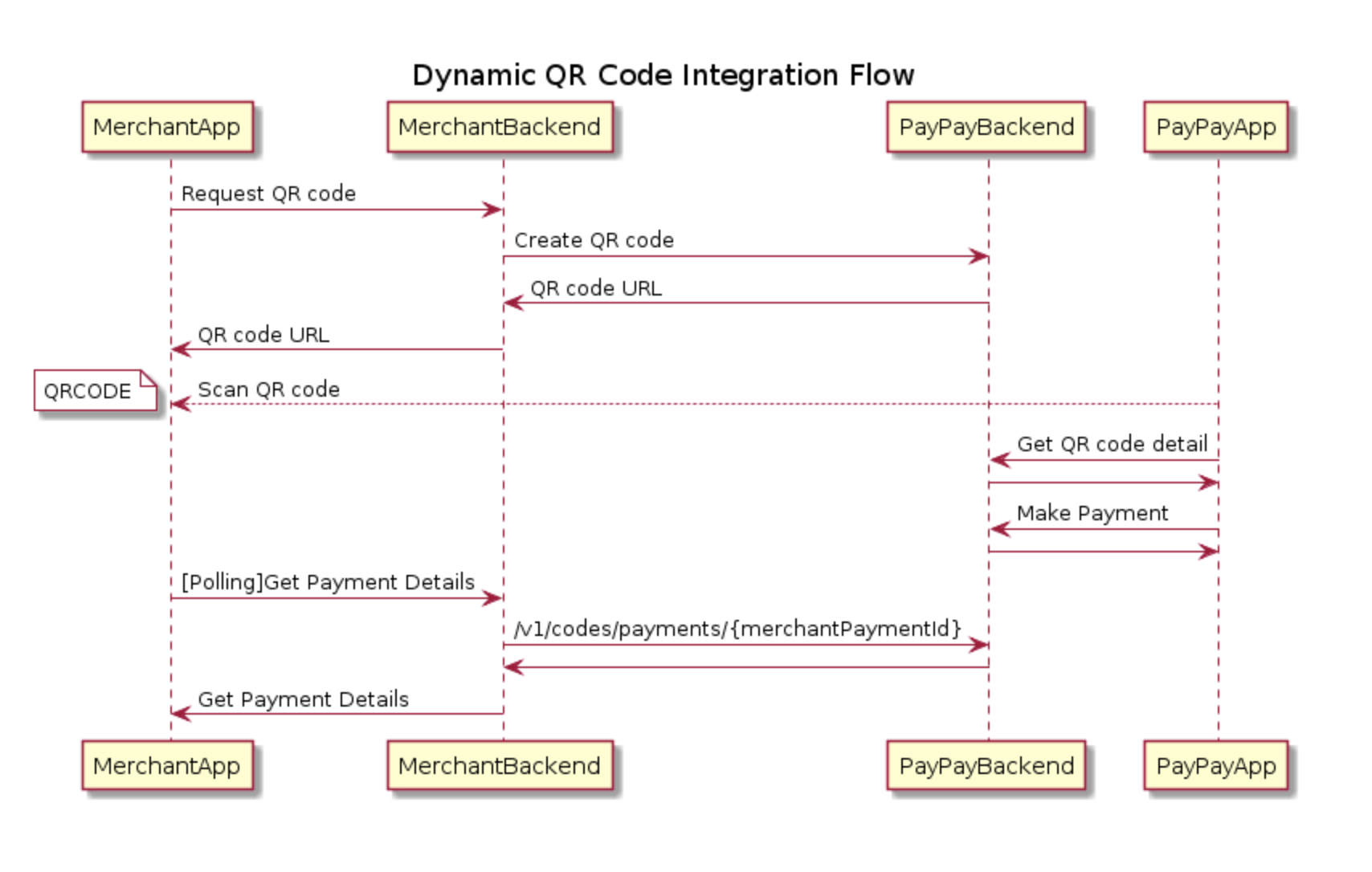

Following diagram defines the flow for Dynamic QR Code.

We recommend that the merchant implements a Polling of the Get payment Details API with a 4-5 second interval in order to know the status of the transaction.

Once you have understood the payment flow, before we start the integration make sure you have:

- Registered for a PayPay developer/merchant Account

- Get the API key and secret from the Developer Panel.

- Use the sandbox API Keys to test out the integration

$ npm i @paypayopa/paypayopa-sdk-nodeBefore making any API calls, you must configure your API key, API secret, and which environment you are using.

For a production API key and API secret, use the "PROD" environment name:

'use strict';

const PAYPAY = require('@paypayopa/paypayopa-sdk-node');

PAYPAY.Configure({

// Use production mode.

env: "PROD",

// Specify your production API key and production API secret.

clientId: API_KEY,

clientSecret: API_SECRET,

});To work in sandbox mode, specify your sandbox API key and API secret, and "STAGING" as the environment name. "STAGING" is the default, so you can also omit the env.

'use strict';

const PAYPAY = require('@paypayopa/paypayopa-sdk-node');

PAYPAY.Configure({

// Use sandbox mode (this is the default).

env: "STAGING",

// Specify your sandbox API key and sandbox API secret.

clientId: API_KEY,

clientSecret: API_SECRET,

});In order to receive payments using this flow, first of all you will need to create a QR Code. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

| amount | Yes | integer <= 11 characters | Amount the user has to Pay |

| codeType | Yes | string <= 64 characters | Please pass the fixed value "ORDER_QR" |

| orderDescription | No | string <= 255 characters | Description of the Order, Click here to check how it will show up |

| isAuthorization | No | boolean | By default it will be false, please set true if the amount will be captured later (preauth and capture payment) |

For details of all the request and response parameters , check our API Documentation guide

let payload = {

merchantPaymentId: "my_payment_id",

amount: {

amount: 1,

currency: "JPY"

},

codeType: "ORDER_QR",

orderDescription: "Mune's Favourite Cake",

isAuthorization: false,

redirectUrl: "https://paypay.ne.jp/",

redirectType: "WEB_LINK",

userAgent: "Mozilla/5.0 (iPhone; CPU iPhone OS 10_3 like Mac OS X) AppleWebKit/602.1.50 (KHTML, like Gecko) CriOS/56.0.2924.75 Mobile/14E5239e Safari/602.1"

};

const response = await PAYPAY.QRCodeCreate(payload);

const body = response.BODY;

console.log(response.STATUS, body.resultInfo.code);Did you get a 200 SUCCESS response, if yes then you are all set for the next step.

Now that you have created a Code, the next step is to implement polling to get Payment Details. We recommend a 4-5 second interval between requests. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

let merchantPaymentId = 'merchantPaymentId';

const response = await PAYPAY.GetCodePaymentDetails([merchantPaymentId]);

const body = response.BODY;

console.log(body.resultInfo.code);

console.log(body.data.status);For details of all the request and response parameters , check our API Documentation guide On successful payment, the status in the response will change to COMPLETED In case of a Preauth for Payment, the status in the response will change to AUTHORIZED

So you want to delete a Code that you have already generated. Following can be possible reasons to use this API:

- User has cancelled the order

- Ensuring race conditions don't come up in the form user has scanned the QR Code and not made the payment and in the meantime the order expires at your end

Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| codeId | Yes | string | This is given as a response in the Create a QR Code method |

const response = await PAYPAY.QRCodeDelete([codeId]);

const body = response.BODY;

console.log(body.resultInfo.code);For details of all the request and response parameters , check our API Documentation guide

So you want to cancel a Payment. In most cases this should not be needed for payment happening in this flow, however following can be a case when this might be needed.

- Polling for Get Payment Details timeout, and you are uncertain of the status

Note: The Cancel API can be used until 00:14:59 AM the day after the Payment has happened. For 00:15 AM or later, please call the refund API to refund the payment.

Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

const response = await PAYPAY.PaymentCancel([merchantPaymentId]);

const body = response.BODY;

console.log(body.resultInfo.code);So the user has decided to return the goods they have purchased and needs to be given a refund. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantRefundId | Yes | string <= 64 characters | The unique refund transaction id provided by merchant |

| paymentId | Yes | string <= 64 characters | The payment transaction id provided by PayPay |

| amount | Yes | integer <= 11 characters | The amount to be refunded |

| reason | No | integer <= 11 characters | The reason for refund |

let payload = {

merchantRefundId: 'merchant_refund_id',

paymentId: 'paypay_payment_id',

amount: {

amount: 1,

currency: 'JPY',

},

reason: 'reason for refund',

};

const response = await PAYPAY.PaymentRefund(payload);

const body = response.BODY;

console.log(body.resultInfo.code);For details of all the request and response parameters , check our API Documentation guide. Please note that currently we only support 1 refund per order.

So you are implementing a PreAuth and Capture, and hence want to capture the payment later. In this case, please ensure you have passed isAuthorization as true in create a code method. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

| merchantCaptureId | Yes | string <= 64 characters | The unique capture transaction id provided by merchant |

| amount | Yes | integer <= 11 characters | Amount to be captured |

| orderDescription | Yes | string <= 255 characters | Description of the Capture for the user |

let payload = {

merchantPaymentId: 'merchant_payment_id',

amount: {

amount: 1,

currency: 'JPY',

},

merchantCaptureId: 'merchant_capture_id',

requestedAt: 1587460334340,

orderDescription: 'Order Shipped, Cake with toppings',

};

const response = await PAYPAY.PaymentAuthCapture(payload);

const body = response.BODY;

console.log(body.resultInfo.code);For details of all the request and response parameters , check our API Documentation guide.

So the order has cancelled the order while the payment was still Authorized, please use the revert a payment authorization method to refund back to the user. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantRevertId | Yes | string <= 64 characters | The unique revert transaction id provided by merchant |

| paymentId | Yes | string <= 64 characters | The payment transaction id provided by PayPay |

| reason | No | string <= 255 characters | Reason for reverting the payment authorization |

let payload = {

merchantRevertId: 'merchant_revert_id',

paymentId: 'paypay_payment_id',

reason: 'reason for revert',

};

const response = await PAYPAY.PaymentAuthRevert(payload);

const body = response.BODY:

console.log(body.resultInfo.code);For List of params refer to the API guide : https://www.paypay.ne.jp/opa/doc/v1.0/dynamicqrcode#operation/revertAuth

So you want to confirm the status of the refund, maybe because the request for the refund timed out when you were processing the same. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantRefundId | Yes | string <= 64 characters | The unique refund transaction id provided by merchant |

let merchantPaymentId = 'merchantRefundId';

const response = await PAYPAY.GetRefundDetails([merchantRefundId]);

const body = response.BODY;

console.log(body.resultInfo.code);For details of all the request and response parameters , check our API Documentation guide.

Native Payments is recommended normally in the following scenarios

- If you want provide your customers with the easiest possible checkout

- You have the security in place to ensure our mutual customers money is safe (We have a strict evaluation procedure to enforce the same)

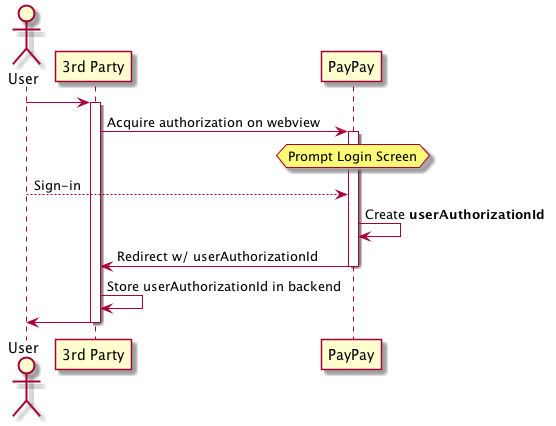

First of all you need to acquire a user Authorization. Following diagram defines the flow to acquire a user authorization.

In order to acquire an authorization you need to create a JWT Token -

| cliam | required | type | description |

|---|---|---|---|

| iss | yes | string | the merchant name |

| exp | yes | number | The expiration date of the authorization page URL. Set with epoch time stamp (seconds). |

| scope | yes | string | direct_debit |

| nonce | yes | string | will be sent back with response for the client side validation |

| redirectUrl | yes | string | The callback endpoint provided by client. Must be HTTPS, and its domain should be in the allowed authorization callback domains |

| referenceId | yes | string | The id used to identify the user in merchant system. It will be stored in the PayPay db for reconciliation purpose |

| deviceId | no | string | The user mobile phone device id. If it is provided, we can use it to verify the user and skip the SMS verification, so as to provide more fluent UX |

| phoneNumber | no | string | The user mobile phone number |

let payload = {

scopes: [

"direct_debit"

],

nonce: "random_generated_string",

redirectType: "WEB_LINK",

redirectUrl: "merchant.domain/path",

referenceId: "reference_id",

phoneNumber: "phone_number",

deviceId: "device_id"

};

// Calling the method to create the account linking QR Code

const response = await PAYPAY.AccountLinkQRCodeCreate(payload);

const body = response.BODY;

// Printing if the method call was SUCCESS

console.log(body.resultInfo.code);

// Printing the link to the generated QR Code

console.log(body.data.linkQRCodeURL);

});Once the user has granted authorization, we will return the UserAuthorizationID as a part of the JWT Token in response/ webhook

# Retrieving userAuthorizationId from response JWT

const jwtResponse = PAYPAY.ValidateJWT(token, API_SECRET);

const userAuthorizationId = jwtResponse["userAuthorizationId"];| Field | Required | Type | Description |

|---|---|---|---|

| userAuthorizationId | yes | string <= 64 characters | The PayPay user reference id returned by the user authorization flow |

// Calling the method to unlink a Payment

const result = await PAYPAY.unlinkUser([userAuthorizationId]);

const body = result.BODY;

// Printing if the method call was SUCCESS

console.log(body.resultInfo.code);Did you get SUCCESS in the print statement above, if yes then the API execution has happened correctly. For details of all the request and response parameters , check our API Documentation guide.

In order to take a payment, you will need to send a request to us with the following parameters:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

| userAuthorizationId | Yes | string <= 64 characters | The PayPay user reference id returned by the user authorization flow |

| amount | Yes | integer <= 11 characters | Amount the user has to Pay |

| orderDescription | No | string <= 255 characters | Description of the Order, Click here to check how it will show up |

let payload = {

merchantPaymentId: "my_payment_id",

amount: {

amount: 1,

currency: "JPY"

},

requestedAt: 1587460334340,

userAuthorizationId: "my_user_authorization_id",

orderDescription: "Mune's Favourite Cake",

};

// Calling the method to create a payment

const response = await PAYPAY.CreatePayment(payload);

const body = response.BODY;

// Printing if the method call was SUCCESS

console.log(body.resultInfo.code);Did you get SUCCESS in the print statement above, if yes then the API execution has happened correctly.

An optional parameter follows the payload argument to specify the agreeSimilarTransaction parameter, which bypasses the payment duplication check.

// Create a payment.

const response1 = await PAYPAY.CreatePayment(payload, false);

// Attempt to create a second payment with the same amount and a different `merchantPaymentId`:

const response2 = await PAYPAY.CreatePayment({...payload, merchantPaymentId: "second-payment-" + Date.now()});

console.log(response2.BODY);

// The request was rejected as a suspected duplicate payment:

// {

// resultInfo: {

// code: 'SUSPECTED_DUPLICATE_PAYMENT',

// message: 'Order is rejected since similar order has been already accepted',

// codeId: '00200017'

// },

// data: null

// }

// Attempt again, this time using agreeSimilarTransaction=true.

const response3 = await PAYPAY.CreatePayment({...payload, merchantPaymentId: "second-payment-" + Date.now()}, true);

console.log(response3.BODY);

// The request was accepted because of the agreeSimilarTransaction=true parameter:

// {

// resultInfo: { code: 'SUCCESS', message: 'Success', codeId: '08100001' },

// data: {

// paymentId: '12345678901234567890',

// status: 'COMPLETED',

// acceptedAt: 1641234567,

// merchantPaymentId: 'second-payment-1641234500',

// userAuthorizationId: 'abcdef00-1234-5678-90ab-cdefabcd0123',

// amount: { amount: 100, currency: 'JPY' },

// requestedAt: 1641234567

// }

// }For details of all the request and response parameters , check our API Documentation guide

Now that you have created a payment, in case the payment request timeout, you can call get payment details method to know the payment status. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

let merchantPaymentId = 'merchantPaymentId';

const response = await PAYPAY.GetPaymentDetails([merchantPaymentId]);

const body = response.BODY;

// Printing if the method call was SUCCESS, this does not mean the payment was a success

console.log(body.resultInfo.code);

// Printing if the transaction status for the code has COMPLETED/AUTHORIZED

console.log(body.data.status);Did you get SUCCESS in the print statement above, if yes then the API execution has happen correctly.

On successful payment, the status in response.data.status will be COMPLETED For details of all the request and response parameters , check our API Documentation guide

So you want to cancel a Payment. In most cases this should not be needed for payment happening in this flow, however following can be a case when this might be needed.

- Initial create payment timeout and you want to cancel the Payment

- Get Payment Details timeout, and you are uncertain of the status

Note: The Cancel API can be used until 00:14:59 AM the day after the Payment has happened. For 00:15 AM or later, please call the refund API to refund the payment.

Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantPaymentId | Yes | string <= 64 characters | The unique payment transaction id provided by merchant |

const response = await PAYPAY.PaymentCancel([merchantPaymentId]);

const body = response.BODY;

// Printing if the method call was SUCCESS

console.log(body.resultInfo.code);Did you get SUCCESS in the print statement above, if yes then the API execution has happend correctly.

For details of all the request and response parameters , check our API Documentation guide

So the user has decided to return the goods they have purchased and needs to be giveb a refund. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantRefundId | Yes | string <= 64 characters | The unique refund transaction id provided by merchant |

| paymentId | Yes | string <= 64 characters | The payment transaction id provided by PayPay |

| amount | Yes | integer <= 11 characters | The amount to be refunded |

| reason | No | integer <= 11 characters | The reason for refund |

let payload = {

merchantRefundId: 'merchant_refund_id',

paymentId: 'paypay_payment_id',

amount: {

amount: 1,

currency: 'JPY',

},

reason: 'reason for refund',

};

// Calling the method to refund a Payment

const response = await PAYPAY.PaymentRefund(payload);

const body = response.BODY;

// Printing if the method call was SUCCESS

console.log(body.resultInfo.code);

});Did you get SUCCESS in the print statement above, if yes then the API execution has happened correctly.

For details of all the request and response parameters , check our API Documentation guide. Please note that currently we only support 1 refund per order.

So you want to confirm the status of the refund, maybe because the request for the refund timed out when you were processing the same. Following are the important parameters that you can provide for this method:

| Field | Required | Type | Description |

|---|---|---|---|

| merchantRefundId | Yes | string <= 64 characters | The unique refund transaction id provided by merchant |

let merchantPaymentId = 'merchantRefundId'

const response = await PAYPAY.GetRefundDetails([merchantRefundId]);

const body = response.BODY;

// Printing if the method call was SUCCESS

console.log(body.resultInfo.code);Did you get SUCCESS in the print statement above, if yes then the API execution has happen correctly.

For details of all the request and response parameters , check our API Documentation guide.

PayPay uses HTTP response status codes and error code to indicate the success or failure of the requests. With this information, you can decide what error handling strategy to use. In general, PayPay returns the following http status codes.

200 Everything works as expected.

201 The requested resource(e.g. dynamic QR code) was created.

202 Means the request is received, and will be processed sometime later.

400 This status code indicates an error because the information provided in request is not able to be processed. The following OPA error code may be returned.

-

INVALID_PARAMS The information provided by the request contains invalid data. E.g. unsupported currency.

-

UNACCEPTABLE_OP The requested operation is not able to be processed due to the current condition. E.g. the transaction limit exceeded.

-

NO_SUFFICIENT_FUND There is no sufficient fund for the transaction.

401 This status code indicates an authorization error. The following OPA error code may be returned.

-

UNAUTHORIZED No valid api key and secret provided.

-

OP_OUT_OF_SCOPE The operation is not permitted.

404 This status code indicates that the requested resource is not existing in the system.

429 This status code indicates that the client sent too many requests in a specific period of time, and hit the rate limits. You should slow down the request sending or contact us to rise your limit.

500

This status code indicates that something went wrong on the PayPay side. A few OPA error code could be returned.

-

TRANSACTION_FAILED This code means the transaction is failed on the PayPay side. You can create new transactions for the same purpose with reasonable backoff time.

-

INTERNAL_SERVER_ERROR This code means that something goes wrong, but we don't know exactly if the transaction has happened or not. It should be treated as unknown payment status.

502,503,504 Treated as unknown payment status.

The recommended timeout setting is specified in each API. The most important one is for the payment creation api, where the read timeout should not be less than 30 seconds. When timeout happens, it should be treated as unknown payment status.

There are two ways to react with this situation:

- Use the query api to query the transaction status. If the original transaction was failed or not found in PayPay, you can start a new transaction for the same purpose.

- Or, you can cancel the transaction, if the cancel api is provided. After the cancellation is accepted, you can start a new transaction for the same purpose.

Common response code

| Status | CodeId | Code | Message |

|---|---|---|---|

| 200 | 08100001 | SUCCESS | Success |

| 202 | 08100001 | REQUEST_ACCEPTED | Request accepted |

| 400 | 08100006 | INVALID_REQUEST_PARAMS | Invalid request params |

| 401 | 08100023 | OP_OUT_OF_SCOPE | The operation is not permitted |

| 400 | 08100024 | MISSING_REQUEST_PARAMS | |

| 401 | 08100016 | UNAUTHORIZED | Unauthorized request |

| 404 | 08100007 | OPA_CLIENT_NOT_FOUND | OPA Client not found |

| 429 | 08100998 | RATE_LIMIT | Too many requests |

| 500 | 08100026 | SERVICE_ERROR | |

| 500 | 08101000 | INTERNAL_SERVER_ERROR | Something went wrong on PayPay service side |

| 503 | 08100999 | MAINTENANCE_MODE | Sorry, we are down for scheduled maintenance |

Create a QRCode

| Status | CodeId | Code | Message |

|---|---|---|---|

| 400 | 01652073 | DUPLICATE_DYNAMIC_QR_REQUEST | Duplicate Dynamic QR request error |

| 400 | 00400060 | PRE_AUTH_CAPTURE_UNSUPPORTED_MERCHANT | Merchant do not support |

| 400 | 00400061 | PRE_AUTH_CAPTURE_INVALID_EXPIRY_DATE | Provided Expiry Date is above the allowed limit of Max allowed expiry days |

| 400 | 01650000 | DYNAMIC_QR_BAD_REQUEST | Dynamic QR bad request error |

Get payment details

| Status | CodeId | Code | Message |

|---|---|---|---|

| 400 | 01652075 | DYNAMIC_QR_PAYMENT_NOT_FOUND | Dynamic QR payment not found |

| 400 | 01650000 | DYNAMIC_QR_BAD_REQUEST | Dynamic QR bad request error |

Delete a QRCode

| Status | CodeId | Code | Message |

|---|---|---|---|

| 400 | 01652074 | DYNAMIC_QR_ALREADY_PAID | Dynamic QR already paid |

| 400 | 01650000 | DYNAMIC_QR_BAD_REQUEST | Dynamic QR bad request error |

| 404 | 01652072 | DYNAMIC_QR_NOT_FOUND | Dynamic qr code not found |

Cancel a Payment

| Status | CodeId | Code | Message |

|---|---|---|---|

| 400 | 00200044 | ORDER_NOT_REVERSIBLE | Order cannot be reversed |

| 500 | 00200034 | INTERNAL_SERVER_ERROR | Request timed out |

Refund a payment

| Status | CodeId | Code | Message |

|---|---|---|---|

| 400 | 00200004 | INVALID_PARAMS | Invalid parameters received |

| 400 | 00200013 | UNACCEPTABLE_OP | Order cannot be refunded |

| 400 | 00200014 | UNACCEPTABLE_OP | Multiple refund not allowed |

| 400 | 00200015 | INVALID_PARAMS | Invalid refund amount |

| 400 | 01103027 | CANCELED_USER | Canceled user |

| 404 | 00200001 | RESOURCE_NOT_FOUND | Order not found |

| 500 | 00200002 | TRANSACTION_FAILED | Transaction failed |

| 500 | 00200003 | TRANSACTION_FAILED | Transaction failed |

| 500 | 00800017 | TRANSACTION_FAILED | Balance exceeded |

| 500 | 00200034 | INTERNAL_SERVER_ERROR | Request timed out |

Fetch refund status and details

| Status | CodeId | Code | Message |

|---|---|---|---|

| 404 | 00200018 | NO_SUCH_REFUND_ORDER | Refund not found |

| 500 | 00200034 | INTERNAL_SERVER_ERROR | Request timed out |

Capture a payment authorization

| Status | CodeId | Code | Message |

|---|---|---|---|

| 202 | 08300103 | USER_CONFIRMATION_REQUIRED | User confirmation required as requested amount is above allowed limit |

| 400 | 00400035 | UNACCEPTABLE_OP | Total transaction limit exceeds merchant limit |

| 400 | 00200039 | ALREADY_CAPTURED | Cannot capture already captured acquiring order |

| 400 | 01103027 | CANCELED_USER | Canceled user |

| 400 | 00400062 | HIGHER_CAPTURE_NOT_PERMITTED | Merchant not allowed to capture higher amount |

| 400 | 00200043 | ORDER_EXPIRED | Order cannot be captured or updated as it has already expired |

| 400 | 00200035 | ORDER_NOT_CAPTURABLE | Order is not capturable |

| 400 | 00200038 | REAUTHORIZATION_IN_PROGRESS | Order is being reauthorized |

| 400 | 00400064 | TOO_CLOSE_TO_EXPIRY | Order cannot be reauthorized as request is too close to expiry time |

Revert a payment authorization

| Status | CodeId | Code | Message |

|---|---|---|---|

| 400 | 00200042 | ORDER_NOT_CANCELABLE | Order is not cancelable |